Importance of credit portfolio and credit risk management in banking system

Отамуродов Хакимжон Хамидович, старший преподаватель;

A credit portfolio is an investment portfolio comprised of debts, like home and car loans. Private investors can build credit portfolios, but more commonly they are held by banks and other financial institutions. Typically, other types of investments are held as well to diversify risk, making the chances of catastrophic investment failures less likely. Companies with an interest in building credit portfolios can purchase a variety of loan products to meet their needs. [1]

Credit portfolio management refers to the process of building a series of investments based upon credit relationships and managing the risks involved with these investments. Such a portfolio gains its value from the interest from issued loans but is susceptible to credit default. For that reason, credit portfolio management includes assessing the risk involved with each potential loan and analyzing the total amount of risk the portfolio incurs as a whole. The process is crucial to individual investors who deal in bonds and to banks who issue loans as a major part of doing business. [2]

Portfolio management is concerned with both investment and credit portfolios. The investment portfolio consists of a few subportfolios, such as the sovereign security portfolio, corporate bond portfolio, equity investment portfolio, mutual funds portfolio, and so on. Management of the investment portfolio is concerned with the protection of investment values against the volatility of market variables. Credit portfolio management deals with the evaluation of each portfolio at periodic intervals to judge the quality of assets held in the portfolio and protect them from losing values through appropriate corrective action in time. For managing the credit portfolio, banks may divide its total credit assets into different portfolios or subportfolios.

Banks may decide the composition of portfolios keeping in view the nature and the distribution of its loans and advances. They may classify total credit exposure into purpose-wise, sector-wise, borrower-type-wise, or even product-wise portfolios. It is, however, advantageous to classify large credits into sector-wise portfolios, like infrastructure sector, manufacturing sector, trade sector, and real estate sector portfolios, and relatively medium- and small-size credits into retail portfolios, like residential housing loan portfolio, auto loan portfolio, personal loan portfolio, education loan portfolio, and credit card portfolio.

Risk is the element of uncertainty or possibility of loss that prevail in any business transaction in any place, in any mode and at any time. In the financial arena, enterprise risks can be broadly categorized as Credit Risk, Operational Risk, Market Risk and Other Risk. Credit risk is the possibility that a borrower or counter party will fail to meet agreed obligations. Globally, more than 50 % of total risk elements in Banks and Financial Institution (FI) s are credit risk alone. Thus managing credit risk for efficient management of a FI has gradually become the most crucial task. Credit risk management encompasses identification, measurement, matching mitigations, monitoring and control of the credit risk exposures. [3]

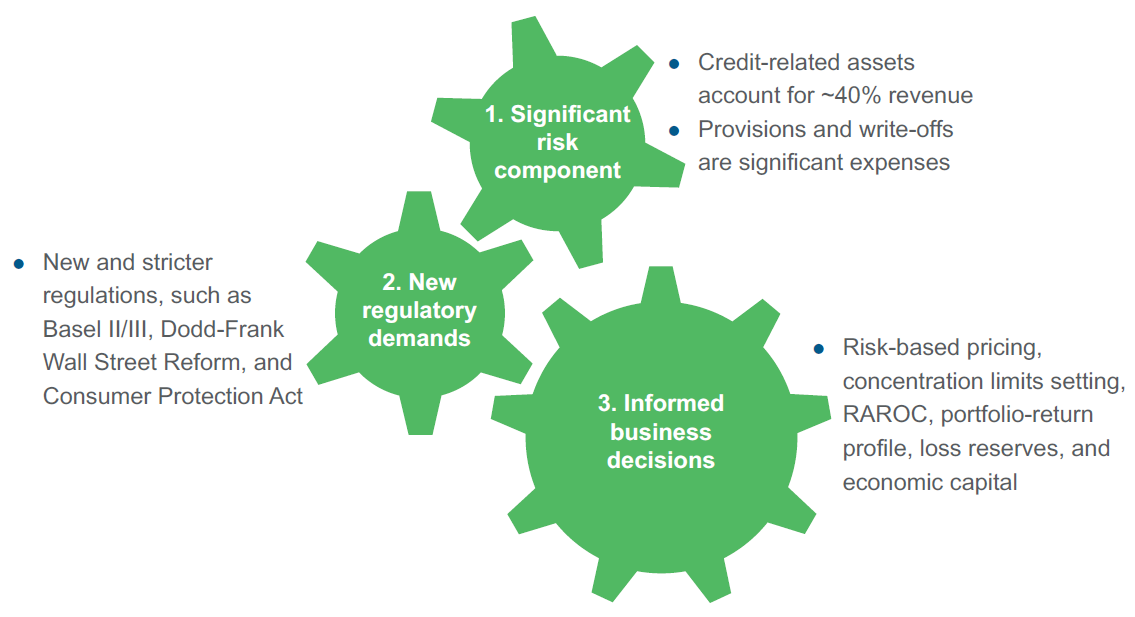

Credit risk (uncertainty associated with borrower's loan repayment) is one of the most significant risks that commercial banks face. Nearly 40 % of the total revenue of a typical commercial bank is generated by credit-related assets. Credit management, including provisions and write-offs, also account for a significant portion of a bank's expenses.

The financial crisis of 2008 exposed the inter-linkages between credit risk, market risk, and liquidity. From January 1, 2008 to April 1 5, 201 1, the FDIC closed 356 banks [4] that failed to manage the risks building up in their residential and commercial mortgage exposures. This unleashed a wave of new and stricter regulations, such as Basel II/III, Dodd-Frank Wall Street Reform, and Consumer Protection Act. The Dodd-Frank Act, for instance, requires companies that sell products, such as mortgage-backed securities, to retain at least 5 % of the credit risk, unless the underlying loans meet standards that reduce riskiness. Stress testing is also required now to ensure credit policy adherence.

Beyond the need to be compliant, effective credit risk management can also lead to significant business advantage. It helps establish a framework that defines corporate priorities, loan approval process, credit risk rating system, risk-adjusted pricing system, loan-review mechanism, and comprehensive reporting system. The outputs from credit risk models help banks in risk-based pricing, exposure and concentration limits setting, Risk Adjusted Return on Capital (RAROC), managing portfolio-return profile, setting loss reserves, and economic capital calculation.

Credit risk management includes both preventive and curative measures. Preventive measures comprise risk assessment, risk measurement, and risk pricing, early warning system to pick signals of future defaults in advance and undertake better credit portfolio diversification. The curative measures aim at minimizing post-sanction loan losses through steps such as securitization, derivative trading, risk sharing, and legal enforcement. Post the financial crisis, most regulators and banks are focused on strengthening preventive credit risk measures. Such preventive analytics enable banks to make better business decisions by providing timely and actionable information and increasing visibility of risks across the organization.

Figure below summarises the drivers for effective credit risk management.

Importance of credit risk management for commercial banks [5]

Credit analytics assigns a probability to the likelihood of default based on quantitative and qualitative factors. It focuses on three components of credit risk:

1. Transaction risk focuses on the volatility in credit quality and earnings resulting from selection, underwriting, and operations;

2. Intrinsic risk is inherent in certain lines of business and loans to certain industries. For example, commercial real estate construction loans are inherently more risky than consumer loans. Intrinsic risk addresses the susceptibility to historic, predictive, and lending risk factors that characterize an industry or line of business;

3. Concentration or portfolio risk is the aggregation of transaction and intrinsic risk within the portfolio and may result from loans to one borrower or one industry, geographic area, or lines of business.

Effective credit risk management solution spans views risks across the entire lending value chain and encompasses reporting, descriptive, predictive, and prescriptive analytics. Credit analytics are required to be compliant and make sound business decisions but banks typically face several challenges while operationalizing advanced credit analytics.

1. Lack of data infrastructure. Unlike market risk, there is scarcity and reliability of credit risk data to be one of the key impediments to the sound design and predictive capability of credit risk models. Credit risk models are influenced by constant shifts in market variables, economic environment, business line products and services, and credit quality;

2. Legacy and outdated IT systems. Pace of regulatory reforms is outpacing systems availability at banks resulting in development of 'workarounds' until technology catches up. Mergers and acquisitions make the systems landscape even more complicated;

3. Large talent gap. Specialized skills, such as model development and model governance, are scarce and expensive resulting in large budgets for consulting projects. Stress testing, ALLL, E-Cap require large investments.

Several best practices are now emerging to help overcome some of these challenges:

Assessment of credit risk across the lending value chain. Effective credit risk management solution spans views risks across the entire lending value chain — origination, underwriting, portfolio monitoring, regulatory reporting, and collections

Integrated enterprise view of risk. Data governance should be centralized across different risk categories including LoB risks (market risks, regulatory risks, fraud and AML/KYC risks) and finance/treasury risks (credit risk and liquidity risk)

Single view of customer. Functional silos prevent banks from calculating concentration risks, as single view of customer is hard to create

Resource centralization and use of third-party providers. Centralization allows banks to break functional silos. Such a model also improves overall utilization of these scarce and expensive resources. Shared services and Global In-house Centers (GICs) are also increasingly leveraged to build such a team. Third-party BPO service providers can also be utilized for risk analytics, data management, testing of systems, and validation of models to quickly scale-up given the severe talent crunch in risk analytics

Thus, credit risk management is one of the biggest risks faced by commercial banks and is assuming even greater importance in a changing regulatory regime and volatile market conditions. Advanced credit analytics are now required to be compliant and to make sound business decisions. However, to successfully operationalize credit analytics, banks need to assess credit risks across the entire lending value chain and build an integrated risk management layer that uncovers interlinkages between credit risk and other risk categories (market risk, fraud, and liquidity risks).

References:

- http://www.wisegeek.com/what-is-a-credit-portfolio.htm

- http://www.wisegeek.com/what-is-credit-portfolio-management.htm

- Raad Mozib Lalon. Credit Risk Management (CRM) Practices in Commercial Banks of Bangladesh: “A Study on Basic Bank Ltd.”.International Journal of Economics, Finance and Management Sciences. Vol. 3, No. 2, 2015.

- FDIC Failed Bank List. www.fdic.gov.

- Credit analytics in commercial banking. research.everestgrp.com