This paper examines the management of Thailand's monetary policy through different stages of economic development. In particular, the article delves into the change in the operating mechanism of Thailand's monetary policy, especially since the Asian financial and monetary crisis. The paper also focuses on analyzing the achievements and limitations in managing monetary policy of Thailand since applying the inflation targeting monetary policy framework. From there, the author gives some susgestion in choosing a monetary policy framework for Vietnam.

Keywords: policy, monetary policy, monetary policy management, target inflation,Monetary policy of Thailand.

The Asian financial crisis of 1997- 1998 affected many aspects of the Thai economy. It raises problems with dormant loans, bad debts and the stability of financial institutions. Since then affecting the growth and stability of the economy... Because of the impact of the crisis, the Government of Thailand has implemented a comprehensive economic policy to overcome past weaknesses and Implementing sustainable development in the new economic context. In particular, monetary policy is a policy of drastic changes reflected by the transparency and transparency in policy implementation. From that time until 2019, Thailand's monetary policy has changed a lot. In this article, the author summarizes the development stages of monetary policy in Thailand and mainly focuses on analyzing the management of monetary policy in the framework of inflation targeting monetary policy — the main stage. Monetary policy has achieved many positive results from which lessons learned in operating monetary policy with Vietnam.

Literature review

In studies of monetary policy and central bank operations in the context of integration, to support the introduction of policy solutions to Vietnam, Phan Nu Thanh Thuy (2007), [1] Overview of monetary policies of the US, Singapore, Thailand, China; Le Van Hai (2013), [2] mentioned the experience of using monetary policy management tools of some developed and developing countries such as Sweden, Finland, Germany, France, China, and Korea. Quoc, Singapore, Japan, Thailand, Philippines... to draw lessons for Vietnam. Besides, Hoang Thi Lan Huong (2013), [3] offers a new perspective on a complete exchange rate policy. The author does not study Thailand's monetary policy management experience but only compares Vietnam's exchange rate policy with its exchange rate policy. Le Quoc Ly (2013), [4] summarizes the general theoretical basis of monetary policy and also presents the content of monetary policy in some countries such as the US, Canada, Australia, Japan, Thailand, China. However, in the study, Thailand's monetary policy management experience is mentioned in the period before 2013 and is still preliminary and not comprehensive.

Thus, from the research results of the works mentioned above, the experience of operating monetary policy of Thailand mentioned by the authors is only a detailed content in the research topic. of the authors and only stop at studying some specific experiences of monetary policy. Therefore, the study of Thailand's monetary policy to draw lessons learned with Vietnam is meaningful in both theoretical and practical terms.

M ethodology Research and theoretical basis for operating monetary policy

To achieve the purpose of this study, the author uses qualitative methods with typical methods:

– Analytical and synthesis method : Based on the analysis of experience in monetary policy management in Indonesia, the article reviews and synthesizes lessons for Vietnam in implementing monetary policy.

– Comparative approach : Through the collection of information, the authors general data on the experience of monetary policy management of Thailand. At the same time, the authors compares and contrasts with the monetary policy management mechanisms of Vietnam; from there, they found similarities and differences in managing monetary policy of Indonesia and Vietnam

The basic theoretical basis for operating monetary policy in the article is based on the Impossibility Trilogy (To Trung Thanh, 2005 [5]). This theory explains that a country can not achieve at the same time three goals of price stability, freedom of capital movement and monetary policy independence. On that basis, countries can choose from two of the three policy goals or neutral models, in which the role of foreign exchange reserves and neutralization measures is important.

The process of changing Thailand's monetary policy frameworks

The development of Thailand's monetary policy is divided into 3 phases:

Phase 1: From World War II to July 1997 — Exchange Rate Targeting

During this period, Thailand operated monetary policy in association with the exchange rate fixing mechanism. Ensuring a fixed exchange rate with the rate given by the central bank every year is the goal of monetary policy during this period. Accordingly, the exchange rate is also used as the main operating tool of monetary policy. In order to implement this exchange rate mechanism, the value of the baht is specified or fixed from the beginning as the main currency in the currency basket. Monetary basket policy was implemented from 1984 to July 1997. During this period, the Exchange Equalization Fund will be responsible for announcing and maintaining the value of the Baht in daily terms. with US Dollar (USD). At the same time, the monetary and financial evaluation method is designed to conform to the fixed exchange rate mechanism. However, monetary and financial measures have gradually shown nonconformity. Although the management of monetary policy has many shortcomings, those limitations are obscured by the stability of the exchange rate under the fixed exchange rate mechanism. The fact has shown that the monetary policy framework associated with the fixed exchange rate mechanism has appeared a number of holes, along with the policy inconsistencies that led to the collapse of the exchange rate mechanism. Fixed exchange and led to the worst economic crisis in Thailand's modern history.

Phase 2: From July 1997 to May 2000 — Monetary Targeting Regime

Following the introduction of the exchange rate floating system on July 2, 1997, Thailand received financial support from the IMF. The monetary policy objectives of this period are aimed to overcome the consequences of the implementation of the fixed exchange rate regime in the previous period. Along with that is the effort to restore stability to the macro economy of Thailand. At the same time, in support of the International Monetary Fund (IMF), a monetary targeting mechanism was adopted. Under this mechanism, the central bank of Thailand has set a target of domestic money supply by means of financial programming to ensure macroeconomic consistency as well as to achieve the ultimate goal of increasing Sustainable growth and price stability. In addition, the central bank of Thailand establishes a basic daily and quarterly budget target, based on which it manages daily liquidity. The daily management of the central bank of Thailand is primarily intended to prevent excessive fluctuations in interest rates and liquidity in the financial system.

Phase 3: From May 2000 to 2019 — Flexible Inflation Targeting

Central Bank of Thailand officially implemented flexible monetary policy Inflation targeting from May 2000. Thailand's central bank first implemented monetary policy of targeting inflation to ensure the consistency of macroeconomic policy with the IMF's support program (Akihiro Kubo, 2007). After the IMF's financial assistance program, the Thai central bank re-evaluated both domestic and foreign environment and concluded that monetary policy mechanism with the goal of money supply will work. less effective than monetary policy mechanism with inflation target.

The main cause of this change is the relationship between money supply and output growth becoming more and more unstable. Especially in the post-crisis period and the uncertainty in expanding credit and the context of the rapidly changing financial sector in Thailand. On the other hand, choosing a monetary policy mechanism associated with a fixed exchange rate is not an optimal option. Other monetary policies that Thailand may refer to as the arbitrary monetary policy framework used by the US Federal Reserve and the Bank of Japan are also considered to be inappropriate for the Bank of Thailand as it is will not give the Thai central bank the necessary means to regain credibility. Therefore, the Bank of Thailand selected and announced the application of flexible inflation targeting monetary policy as the new monetary policy framework on May 23, 2000.

The special thing in running Thailand's monetary policy is that the Central Bank of Thailand has been proactively applying the Monetary Policy of inflation targeting flexibly in its management right from the time of applying the Inflation targeting policy framework to the present time.

Under flexible inflation targeting mechanism, the most important objective of monetary policy is price stability. These contents are specified in the Law of the Central Bank of Thailand in 2000. Accordingly, every year, the Central Bank of Thailand gives specific inflation target and publish to the public.

Before applying monetary policy inflation targeting

Before applying the operating mechanism of monetary policy within the framework of monetary policy, Thailand applied the monetary policy associated with two mechanisms: fixed exchange rate mechanism and monetary mechanism. target towards money supply.

The administration of monetary policy attached to the fixed exchange rate mechanism was one of the main reasons leading to Thailand's severe crisis in 1997. Before 1997, Thailand had a current account deficit. In 1996, this figure was 14.6 billion USD — equivalent to 8 % of GDP. The Central Bank of Thailand then pegged the local currency at 25 Baht per US $ 1 and attracted short-term foreign currencies by setting high interest rates. Thai banks and businesses then used the money to carry out domestic projects. However, when people lost faith in the Baht, this investment flow immediately reversed. Central Bank of Thailand kept the exchange rate, but foreign reserves were quickly depleted. Thailand had to float its currency, and the Baht collapsed. By the end of 1997, the baht had depreciated against the dollar at 58 baht per dollar. It is worth mentioning here that there is a lack of financial transparency in the administration of Thailand's monetary policy reflected in the central bank of Thailand announcing the size of foreign exchange reserves recorded on the Balance Sheet. It's a lot bigger than it actually is.

Looking back on the cause of the crisis that Thailand experienced in 1997 from the application of the fixed exchange rate mechanism in operating the monetary policy also shows: The underlying cause of this crisis is not due to the poor governance of the Central Bank of Thailand, which does not recognize the benefits and needs for the floating exchange rate mechanism (Goldstein — 1998). The crisis reflected the mismatch between the development model and the economic context at that time. Thailand's economic development model, applied at the time, emphasized that a stable exchange rate is needed for increasing exports. It emphasizes on investment no matter how much to achieve double-digit growth, it also encourages external borrowing. Therefore, the selection of exchange rate fixing mechanism in operating the monetary policy at this stage of failure is inevitable.

Thus, the operation of monetary policy associated with the exchange rate fixation did not bring the effectiveness of monetary policy to Thailand. On the contrary, it also made Thailand, a country that has had four decades of unbroken economic growth, admired by the whole world and known as one of the Asian tigers.

After the crisis, the Central Bank of Thailand operated monetary policy under the default target monetary mechanism. With the target set at the money supply, with the support of USD 17.2 billion from the IMF and many positive and resolute measures in managing the commercial banking system and financial restructuring, Thailand have overcome some consequences of crisis. However, the operating mechanism of this monetary policy did not bring about the operating efficiency as the set target. The target monetary mechanism with the goal of the money supply showed many heterogeneities with the chapter. IMF support program. In particular, the relationship between money supply and output growth is becoming increasingly unstable, credit expansion becomes uncertain. Therefore, the Central Bank of Thailand needs and has made changes in the administration of monetary policy to better suit the situation of the Thai economy at that time.

Thus, with both the operating mechanisms of monetary policy Thailand applied before the application of monetary policy, inflation targeting did not help Thailand achieve growth as well as monetary policy targets. fabricate.

Within the framework of monetary policy of inflation targeting

For about 19 years of implementing the Monetary Policy of inflation targeting, Thailand is considered as one of the successful countries in applying this mechanism. The results of applying this policy are reflected in the following three main expressions: (1) price stability, (2) economic growth and (3) interest rates and exchange rates more stable. In addition, monetary policy targeting inflation has a positive impact on other issues such as helping to improve the quality of banking operations, comprehensive governance system and improve financial transparency of the whole Financial system of Thailand.

Since implementing the Monetary Policy of inflation targeting, Thailand has reduced the inflation down to the level of price stability and kept it close to that level. This is expressed through average inflation and its volatility.

Table 1

Average inflation before and after applying the inflation targeting policy

|

Nation |

Average inflation (%) |

|||

|

Period from year 1981–1990 |

Period from year 1991–2002 |

5 years before implementing IT |

Years after implementing IT |

|

|

Thailand |

4,4 |

4,0 |

4,9 |

1,3 |

|

The nations |

113,1 |

40.8 |

31,4 |

4,5 |

|

Group of countries that apply IT |

9,9 |

3,3 |

9,0 |

3,4 |

(Source: Thórarinn G. Pétursson — 2005)

The average inflation in all countries from 31.4 % in the 5 years before the application was reduced to 4.5 % after the application of the target inflation monetary policy. For Thailand, inflation decreased from 4.9 % in the 5 years before the application to 1.3 % in the year after applying the inflation targeting monetary policy. Thus, we can see that inflation of Thailand and other countries after applying the Monetary Policy of inflation targeting has decreased significantly. Comparing the average inflation after applying the monetary policy to the target inflation with the average inflation of 5 years before applying shows that the monetary policy target inflation has contributed to reducing inflation.

Besides reducing average inflation, Thailand also kept inflation within the set target.

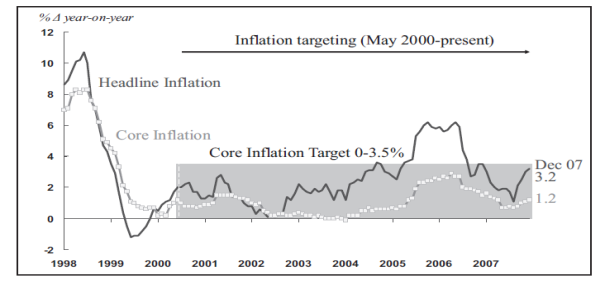

Fig. 1. CPI and basic inflation, 1998–2009 (Source: Don Nakornthab — 2009)

According to the statistics of Thórarinn G. Pétursson (2005): Thailand's inflation volatility decreased from 3.2 % in 5 years before applying the CASH POLICY to target inflation to 0.7 % after apply. This result is also indicated by the research of Neumann and Von Hagen (2002). The study of Siregar, Reza Yamora and Goo, Siwei (2009) also showed that Thailand's basic CPI and inflation at 2 years before applying the corresponding monetary policy of inflation is 2.81 %. (+/- 3.82 %) and 3.28 % (+/- 2.98 %) to 1.51 % (+/- 0.75 %) and 1.01 % (+/- 0.36) 2 years later. The results demonstrate that Thailand's basic CPI and inflation both decreased and its fluctuation range was narrower. Thus, from the research results, it can be concluded that Thailand's inflation targeting monetary policy has achieved remarkable success in stabilizing prices.

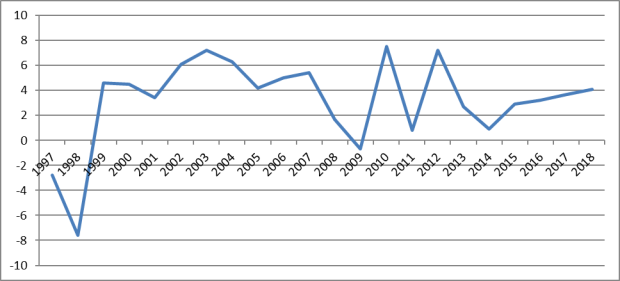

Thailand's economic growth in the period 1997–2018 through the following chart:

Fig. 2. Thailand economic growth, 1997 - 2018 (Source: World Bank, 2018)

The chart shows that, since Thailand officially adopted the inflation targeting monetary policy framework (May 2000), Thailand's economic growth has improved significantly. In addition to the period 2008–2011, which was affected by the global financial crisis and 2014 due to political instability, Thailand's growth rate was low in 2009, 2011 and 2014. The average growth of the remaining years of Thailand is about 4.7 %. The fluctuation of growth rate between years is not too large. Especially, in the last 5 years, the growth rate of Thailand has been steadily increasing and continuously increasing. By 2018, Thailand's growth rate reached 4.1 %, the highest in the past 6 years.

In addition, the application of inflation targeting monetary policy has also contributed to reducing interest rates and interest rates in Thailand, and the gap between lending and deposit rates has also narrowed. at the same time stabilizing the exchange rate

Lessons learned for Vietnam

From the current situation and results of operating the Monetary Policy of Thailand's inflation targeting, the following experiences are recorded as follows:

Firstly, in order to accomplish the goals in the ever-changing economic context, Thailand's monetary policy is operated in the direction of flexible monetary policy of inflation targeting. Accordingly, besides the main goal of inflation, Thailand also flexibly regulates monetary policy to achieve the goal of economic growth and financial stability in the short term.

Secondly, during the period since the application of the inflationary monetary policy framework, Thailand has established a very clear policy goal system, especially the final one. In each stage of economic development, Thailand has announced its expected target inflation level and the basis for calculating inflation m. At the same time, the Central Bank of Thailand also showed a clear position consistently that goal. With the target inflation announced, the Central Bank of Thailand carries out all executive activities to achieve the target. This has demonstrated the success of monetary policy Thailand in the framework of inflation targeting, reflecting the ability of monetary policy to anchor inflation expectations effectively.

Setting inflation targeting and inflation definition is also very flexible in each period. From May 2000 to April 2015, the inflation target was core inflation — this type of inflation was assessed to be less volatile in the short term. The target inflation rate in the period 5/2000 to 2009 was determined from 0–3.5 % in order to increase export competitiveness, while leading to the stability of the Baht. In addition, the 3.5 % fluctuation band will help reduce temporary economic shocks and minimize the needs of the monetary policy adjustment policy. Through it it reduces short-term interest rates and promotes financial stability. This target inflation rate was adjusted at 0.5–3 % to avoid the risk of deflation from 2009 to April 2015. From April 2015 until now, the target inflation has been changed. Inflation targeting is defined as general inflation at 2.5 % (+/- 1.5 %). The redefining of inflation targeting and inflation during this period aims to promote faster economic growth and a better appreciation of the structure of the economic sector.

Thirdly, Thailand attaches great importance to domestic and international macroeconomic analysis and forecasting. Because there is a delay of 4–8 quarters in the transmission of monetary policy from the time the Central Bank used the monetary policy tool to the time the monetary policy was reached, the Central Bank of Thailand Lan has built and developed an econometric model to predict macroeconomics. In addition, an early warning system has been developed to monitor macroeconomic gaps and warn of risks that may harm the stability of the economy. With such activities, Thailand has been proactive in setting goals, selecting monetary policy instruments and choosing the right time to implement market interventions to achieve set goals. therefore, shortening the latency of the policy and improving the efficiency of operating monetary policy.

Fourth, the Central Bank of Thailand particularly promotes transparency and accountability in the administration of monetary policy. Central Bank of Thailand places special importance on and seriously implements this point because it was the opacity of the previous monetary policy that was the main reason for Thailand's crisis. The transparency in the decision-making process and accountability for policies that Thailand implements when applying the Monetary Policy monetary framework have helped Thailand to build, strengthen the prestige and credibility of Thailand. public with Central Bank. According to the operating mechanism of monetary policy, the Central Bank determines that the primary task of monetary policy is to keep prices stable. That forced Thailand's Central Bank to have high accountability, credibility and high credibility to the public, thereby contributing to the expected anchor of inflation. In the event that the inflation target is not reached (actual inflation rate is higher or lower than the target), the Central Bank clearly explains the cause of the inflation target not being achieved. It is these positive management activities that have shown transparency and accountability as one of the most remarkable points in the administration of Thai Lant's monetary policy within the framework of monetary policy policy. pepper.

Fifth, in order to effectively operate the Monetary Policy of inflation targeting, Thailand clearly defined that: The Central Bank must be independent of the Government. By properly identifying that relationship, Thailand has built an institution that operates the monetary policy with relative independence with the Government to carry out its duties. Accordingly, an established monetary policy Committee is responsible for the orientation of monetary policy. It is the independence of the Central Bank of Thailand that not only helped Thailand consistently realize the goals of the monetary policy but also created the autonomy of the Thai Central Bank in administering the national Monetary Policy. to curb inflation, stabilize the value of money to avoid external shocks. This is also one of the successes that Thailand has achieved since applying the monetary policy of inflation targeting.

Sixthly, Thailand boldly transformed from a fixed exchange rate operating mechanism to a regulated floating exchange rate mechanism and to a completely floating exchange rate mechanism (at the time...). This choice is entirely consistent with the reality of operating the Monetary Policy of inflation targeting in Thailand and is suitable both in the theoretical aspect of «Impossible Triad». According to this theory, the administration of Thailand's monetary policy and the floating exchange rate mechanism at the present time clearly shows the stance of the Central Bank of Thailand in selecting the main target. its policies are: Liberalizing capital flows and monetary policy independently, giving up the stability (fixed) rate. It is this choice that helps Thailand's Central Bank to take the initiative in using its policy tools to achieve its set goals.

References:

- Phan Nu Thanh Thuy (2007), “Hoàn thiện chính sách tiền tệ Việt Nam trong quá trình hội nhập quốc tế” (“Completing Vietnam's monetary policy in the process of international integration”), University of Economics Ho Chi Minh City.

- Le Van Hai (2013), «Nghiên cứu công cụ điều hành chính sách tiền tệ trong điều kiện thực thi luật ngân hàng thời kỳ hội nhập» (“Study monetary policy management tools in the context of the implementation of banking law in the integration period”), Banking University of Ho Chi Minh City.

- Hoang Thi Lan Huong (2013), “Hoàn thiện chính sách tỷ giá ở Việt Nam giai đoạn 2010–2020” (“Completing the exchange rate policy in Vietnam for the period 2010–2020”), National Economics University.

- Le Quoc Ly (2013), “Chính sách tiền tệ — lý thuyết và thực tiễn” (“Monetary policy — theory and practice”), National Political Publishing House.

- To Trung Thanh (2015), “Lý thuyết bộ ba bất khả thi” (“Trilogy theory impossible”), Application of theories in economic research, National Economics University.

- To Thi Anh Duong (2015), “Áp dụng chính sách lạm phát mục tiêu: Lý luận và Thực tiễn” («Applying inflation targeting policy: Theory and Practice»,). Social Science Publishing House

- Akihiro Kubo, (2007). Macroeconomic impact of monetary policy shocks: Evidence from recent experience in Thailand. Journal of Asian Economics 19 (2008).

- Moenjak, T., Imudom, W., & Vimolchalao, S. (2004). Monetary policy and financial stability: Finding the right balance under inflation targeting. Bank of Thailand Discussion Paper DP/08/2004.

- Sherwin, M. (2000), Institutional Frameworks for Inflation Targeting, Bank of Thailand Symposium «Practical Experiences on Inflation Targeting», Bangkok, 20 October 2000.

- http://www.thailandtoday.in.th/economy/overview.

- https://www.nordeatrade.com/fi/explore-new-market/thailand/economical-context.