The main purpose of my study is to make contribution to the Kazakhstan research regarding the evaluation of banks deposits decomposition and checking the effect of crisis 2008. This research is significant, among so many researches in our country there is no any research regarding to the evaluation of deposits decomposition of traditional banks that is why we decided to fulfill this gap and make important contribution to KZ economy.

Our research based on empirical analysis of 10 largest banks of Kazakhstan with purpose to empirically evaluate decomposition of deposits of Kazakhstan commercial banks before and after crisis 2008 and to reveal if there are any patterns in decomposition of bank deposits among Kazakhstan banks. In our research we used descriptive statistics, regression analyses and trend analysis in order to test our research hypotheses.

Consequently, results from empirical analysis indicates that there is no any pattern in deposits decomposition among Kazakhstan’s commercial banks; also, we found that bank specific factor’s influence is not significant; and changes in Demand Deposits, Large Time Deposits and Multicurrency Deposits by the effect of crisis 2008 are positive.

Key words: commercial banks, descriptive analysis, regression, trend analysis.

Commercial banks are crucial to a country’s economy; they serve as the center point of the exchange of money throughout the economy; they have role as primary providers of financial services [1], [2], [3], [4]. Banks gather savings from small and large depositors, make loans, run the payments system, and coordinate financial transactions [5].

But banks can fail, just like other firms, because banks are businesses that tend to make a profit in an uncertain market, and their failure would have broader outgrowth- hurting customers, other banks, the community, and the market as a whole [6]. So, bank safety and soundness are a major public policy concern and government policies have been designed to limit bank failures by overprotecting deposits, because deposits play important role in the funding of bank operations, that the major source of the Bank’s funds for lending and other investment purposes.

During the past few decades, the composition of bank funding has changed significantly due to various structural developments. Deposits are source of funds that the bank has available to ensure that its role in the settlement process is not endangered, which would require borrowing from the central bank. The Bank intends to fund its activities primarily through deposits, because domestically sourced deposits are usually cheaper seeking funds than from money and capital markets [7].

Statement of the problem

Due to the short period of experience and working in high risk conditions Kazakhstan’s banks often find themselves at a loss when they run into unexpected and undesirable economic circumstances. The world financial crisis 2008 most deplorably affected our country`s financial system, therefore heavily affected banking system also. Isabel Gorst (2013) stated about the capability of Kazakhstan banks to generate foreign funds. She proclaimed that the financial crisis 2008 happened because our Kazakhstani banks over previous decade have lapped up cheap foreign loans to finance a consumer boom, this boosted boom driven by great petrol reserves in Kazakhstan. Banks had created too much money, too quickly, and used it to push up house prices and speculate on financial markets. Every time a bank made a loan, new money was created. In the run up to the financial crisis, banks created huge sums of new money by making loans [8]. “In just 7 years, financial institutions of Kazakhstan doubled the amount of money and debt in the economy and used this money to push up house prices and speculate on financial markets” [9]. By looking for quick ways to make a profit, Kazakhstani banks borrowed significant sums of money from U. S. banks involved in hedge funds. “During 2006 alone, Kazakhstani banks obtained more than US$18 billion in international credits” [10].

Restrictions on borrowed capital from the external foreign banks, due to the financial crisis, reduced the ability of our local banks to refinance previously received loans and obtain new ones- it caused intense outflows from the banking sector. It shows that inappropriate deposits decomposition of KZ banks during crisis 2008 affected to their performance, due to the relying mostly on wholesale funding Kazakhstani banks uncured huge losses. It is all suggest that crisis will force banks to change deposit decomposition in order to use careful source of funds.

Research questions

- Whether there are any patterns in deposits decomposition among KZ banks?

- What factors drive these differences in deposits decomposition among banks?

- What changes we may expect in deposits decompositions under the influence of the crisis?

Data and Methodology

In order to evaluate deposits decompositions of Kazakhstan commercial banks and assess the impact of financial crisis 2008 the research was conducted through using statistical methods on the basis of qualitative and quantitative approaches: descriptive statistics, descriptive statistics, multiple liner regression and trend analyses.

Data collection

In order to examine the performance of depository institutions while all relevant financial information is available for public the most ideal applicants are the financial statements of commercial banks. The current research is based on data collected from quarterly (700H) and audited financial statements of 10 Kazakhstan second level banks listed in KASE in the period of 2006–2015 [11].

All data are sourced from KASE database, NBK database and some banks’ data comes from their reports on home websites.

Research sample

The following criteria used for sample selection of banks:

– Existing no less than 10 years

– All banks are commercial second-level banks

– Banks are listed on the KASE

– All banks are deposited institutions

According with the criteria above, we selected 10 largest commercial banks. The sample started from 2006 till 2016 in order to observe how commercial banks had served before the crisis of 2008 and after crisis period. The study uses quarterly data from January 2006 to January 2015. To avoid the disturbance from affecting the results of the analysis, tests are done over separate sub-periods and also over the whole period. The crisis period covers the period of 2007–2009 years.

Table 1

List of banks used in the analyses

|

№ |

Name of two-tier bank |

Assets |

|

1 |

«Kazkommertsbank» |

5051837269 |

|

2 |

«Halyk Bank Kazakhstan» |

4053885722 |

|

3 |

«Tsesnabank» |

1939194777 |

|

4 |

“SB Sberbank of Russia” |

1596599552 |

|

5 |

«Bank CenterCredit» |

1440498528 |

|

6 |

«KASPI BANK» |

1243749867 |

|

7 |

«ATFBank” |

1204545666 |

|

8 |

«ForteBank» |

1065707128 |

|

9 |

«Eurasian Bank» |

1037679129 |

|

10 |

«RBK Bank» |

876854667 |

|

Note: provided by author |

||

Data analysis techniques

Descriptive Statistics- used to compare the deposits decomposition of banks and identify if there are any patterns in deposits decompositions among Kazakhstani banks. Mainly decomposition of Corporate and Individual deposits, if they’re any relationship in decomposition of CD and ID among 10 largest Kazakhstani banks. It provides main characteristics of all analyzing variables separately needed to assess the whole picture of the observation, which are mean value, standard error of mean, median, standard deviation, variance, minimum and maximum values. Total number of observations amounts to 100. With the help of mean I identified composition of Corporate and Individual deposits to Total deposits and I had observed how it differ among chosen banks.

Regression Analysis linear — used to determine the significance of the each explanatory (independent) variable in affecting each item of deposits decompositions of banks (dependent variable). Our explanatory variable is the size of the banks.

The basic model of 2 objective was adapted to a simple linear regression framework, which is:

Yi = β0+ β1 (x1)i

2.4. Variables

There are two main variables used in our regression analysis: dependent

and independent.

a. Dependent variables

CD=DDC+SAC+TDC

Corporate Deposits (CD) is equal to Demand Deposits of Clients (DDC) plus Savings accounts of Clients (SAC) plus Times deposits of Clients (TDC). Times deposits of Clients (TDC) is equal to Short-term Deposits of clients (STDC) plus Long-term Deposits of clients (LTDC)

D ratio=Corporate Deposits/Total Deposits

E ratio=Corporate Deposits/Total Assets

Ratio of corporate deposits to total deposits and ratio of corporate deposits to total assets should decline from 1 to 10.

ID=DDI+SAI+TDI

Individual Deposits (ID) is equal to Demand Deposits of Individuals (DDI) plus Savings accounts of Individuals (SAI) plus Times deposits of Individuals (TDI). Times deposits of Individuals (TDI) is equal to Short-term Deposits of Individuals (STDI) plus Long-term Deposits of Individuals (LTDI)

b. Independent variables: size

(size of Kazakhstan Commercial banks according to the amount of assets as on January 2016.)

Trend analysis - used to analyze and compare banks data over time to identify any consistent trends, especially to compare effect of the crisis on the composition of deposits. We used trend analysis to see how crisis is affected to deposits decompositions of KZ banks. Crisis — independent factor, we took period from 2006 till 2010, to see the effect, by capturing period of crisis 2008.

2.5. Model specification

Schematic Diagram showing the relationship between variables by using three analysis techniques above.

Fig. 1. Note: model provided by author

Related hypotheses of the study

In order to reveal if there are any pattern in deposits decomposition among Kazakhstani banks, we have developed our research hypothesis, which looks like:

1. H0 = 0 (if there are any patterns in decomposition of bank deposits among Kazakhstan banks);

H1 =/0 (if there is no any patterns in decomposition of bank deposits).

Firstly, we analyzed using descriptive statistics proportion of particular forms of deposits for a period of 2006–2015, next objective is to identify what factors drive these differences in decomposition of deposits among banks by testing the following hypothesis where we focus on potential most probable factors that might affect decomposition of deposits, which is:

– Size of banks (Moses M. Sichei, 2005) [12].

2. H0 = 0 (larger banks have higher proportion of corporate deposits)

H1 ≠ 0 (there is no significant differences in composition of deposits between large and small banks)

Relating to the last objective which is about analyzes of the effect of crisis on composition of deposits of Kazakhstani commercial banks, based on studies (Carlos D. Ramirez, 2010), (Asli Demirguc-Kunt et al, 2014), (Maria Soledad Martinez Peria, 1999), (Victoria Ivashina and David Scharfstein, 2008), (Enrica Detragiache 2000) we shall expect following changes:

3. H0 = 0 Decrease in demand deposits

H1 ≠ 0 DD will not decrease

4. H0 = 0 Decrease in large time deposits

H1 ≠ 0 LTD will not decrease

5. H0 = 0 Increase in multicurrency deposits

H1 ≠ 0 Multicurrency deposits will not increase

Data Analysis

3.1. Descriptive statistics

Descriptive statistics’ analysis is basically developed in order to find out the any patterns in deposits decompositions among 10 largest banks of Kazakhstan. Mainly decomposition of Corporate and Individual deposits, if there any relationship in decomposition of CD and ID among 10 largest Kazakhstani banks.

Table 2

Descriptive statistics’ results

|

Count |

Minimum |

Maximum |

Mean |

Standard deviation |

|

|

CD |

99 |

-0,74 |

0,88 |

0,012 |

0,39 |

|

ID |

99 |

-1,45 |

1,34 |

1,907 |

1,921 |

|

Note: Complied by author based on results of statistical excel program descriptive statistics |

|||||

Table 2 shows that Standard deviation of CD is 0.39 and ID 1,921. We can see that minimum and maximum ratios of CD and ID are equal to -0.74 and -1.45 respectively. Their mean value is expressed as 0.012 which is 1.2 %, and 1.907 which is 190.7 % respectively. CD of 10 commercial banks is 1.2 % which is lower than ID of banks, indicating that CD composition of banks have no similar patterns with ID of Kazakhstani banks’ deposits. Based on this we can say that Kazakhstani banks are free in choosing the most appropriate deposits decomposition based on their management.

Regression Analysis

This section is present the output of the regression analysis, to explain how any change in the independent or explanatory variables (bank’s specific factors: size, CAR, ROA) will affect the deposits decompositions (TD, CD, and ID).

Table 3

10 largest banks of KZ

|

№ |

Name of two-tier bank |

Total Assets |

d ratio |

e ratio |

|

1 |

«Kazkommertsbank», JSC |

2946368428 |

66,36 % |

30,92 % |

|

2 |

«Halyk Bank Kazakhstan», JSC |

2077077246 |

61,56 % |

38,58 % |

|

3 |

«Tsesnabank», JSC |

1012584283 |

55,78 % |

30,94 % |

|

4 |

SB Sberbank of Russia, JSC |

964310764,9 |

65,32 % |

31,13 % |

|

5 |

«Bank CenterCredit», JSC |

716485034,2 |

63,89 % |

25,12 % |

|

6 |

«KASPI BANK», JSC |

532625326,5 |

71,16 % |

46,11 % |

|

7 |

«ATFBank», JSC |

517852082,8 |

67,16 % |

46,28 % |

|

8 |

«ForteBank», JSC |

495313711,3 |

43,16 % |

22,03 % |

|

9 |

«Eurasian Bank», JSC |

414075067,6 |

71,03 % |

39,60 % |

|

10 |

«RBK Bank», JSC |

105248851,6 |

81,35 % |

35,42 % |

|

Note — Compiled by author in accordance with data from current analyses |

||||

Linear Regression

This section is presenting the output of the regression analysis, to explain how explanatory variables (banks’ specific factors) will affect the deposits decompositions items.

Simple linear regression model was used by previously research Moses M. Sichei (2005). In the pure regression model, all internal factors are taken into consideration and a regression is run on all banks in the sample.

The following regression results show the impact of bank-specific size factor on the deposits decomposition of banks in Kazakhstan in a table below.

Table 4

Regression analysis e ratio

|

SIZE specific factor of banking sector |

Y e ratio (CD/TA) |

|

R square |

1,7 % |

|

Adjusted R square |

13,2 % |

|

SE coefficient |

1,19 |

|

F-test |

0,141 |

|

P-value |

0,030 |

|

Note — Compiled by author in accordance with data from current analyses |

|

Regression of total assets to e ratio shows that relationship is insignificant. Which means that bank size doesn't have any significant effect on the proportion of corporate versus individual deposits.

Table 4

Regression analysis d ratio

|

SIZE specific factor of banking sector |

Y d ratio (CD/TD) |

|

R square |

2,3 % |

|

Adjusted R square |

15 % |

|

SE coefficient |

1,56 |

|

F-test |

0,186 |

|

P-value |

0,038 |

|

Note — Compiled by author in accordance with data from current analyses |

|

Regression of total assets to d ratio shows that relationship is insignificant, although stronger than that for the e ratio. Which means that bank size doesn't have any significant effect on the proportion of corporate versus individual deposits.

Trend analysis

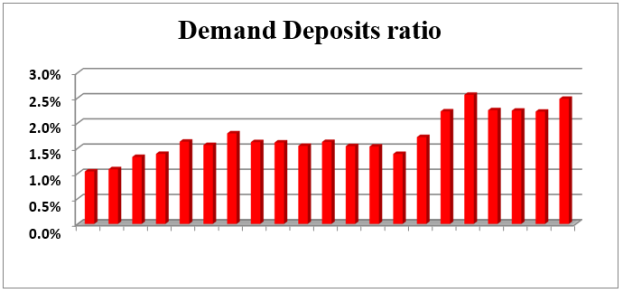

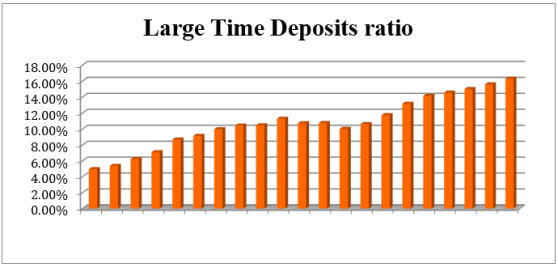

Trend analysis used in my study in order to see the effect of the crisis 2008 to the decomposition of deposit portfolio. Following three graphs below illustrate the overall trend of banks’ deposits decompositions, especially Multicurrency deposits.

Demand deposits and Large time deposits for the period 2006–2010 (capturing crisis 2008). We took overall banking sector data, especially MCD, DD, LTD and we built following graphs in order visually see trend, changes under the effect of crisis 2008.

Table 6

Multicurrency Deposits, Demand Deposits, Large Time Deposits

|

Data |

Demand Deposits |

Large Time Deposits |

Multicurrency Deposits |

Total Assets |

|

12.05 |

103408 |

492073 |

284615 |

9937238 |

|

03.06 |

107176 |

529803 |

269078 |

9883723 |

|

06.06 |

131204 |

616172 |

250187 |

9883732 |

|

09.06 |

138939 |

708302 |

305926 |

10000123 |

|

12.06 |

163191 |

868071 |

344543 |

10003827 |

|

03.07 |

172482 |

1007874 |

329397 |

11023844 |

|

06.07 |

208313 |

1156773 |

344218 |

11600293 |

|

09.07 |

188625 |

1211632 |

478504 |

11630331 |

|

12.07 |

193158 |

1250778 |

544722 |

11960634 |

|

03.08 |

180570 |

1315600 |

561515 |

11672868 |

|

06.08 |

194032 |

1278981 |

542206 |

11938030 |

|

09.08 |

193772 |

1348890 |

541633 |

12560690 |

|

12.08 |

198734 |

1297772 |

628075 |

12952594 |

|

03.09 |

185607 |

1420781 |

991732 |

13373177 |

|

06.09 |

209022 |

1422683 |

934590 |

12137542 |

|

09.09 |

270518 |

1594024 |

1103775 |

12116001 |

|

12.09 |

296240 |

1636889 |

1095294 |

11558771 |

|

03.10 |

264993 |

1708345 |

1006901 |

11745157 |

|

06.10 |

265196 |

1770106 |

973885 |

11798222 |

|

09.10 |

266635 |

1864546 |

1011704 |

11967446 |

|

12.10 |

296651 |

1948069 |

1000193 |

11948931 |

|

Note — Compiled by author in accordance with data from current analyses |

||||

Table 6 above shows us Kazakhstan banking sector’s decomposition of Demand Deposits, Large Time Deposits, Multicurrency Deposits, and Total Assets for the period before and after crisis 2008 with aim to see effect of this crisis on each composition of KZ banks’ deposits. In order to eliminate the problem with absolute numbers, we conducted ratios by dividing each deposits types by the amount of Total Assets and constructed following charts, in order to visualize results and see tendency, especially effect of crisis and changes which happened in the process.

Fig. 2. Demand Deposits for 2006–2010 period [ Note — Compiled by author in accordance with data from current analyses]

On the Fig. 2. above we see that Demand deposits at first step slightly decreased, then right after sharply increased. Therefore, we reject H0 which states that demand deposits will decrease under the effect of crisis, because there is some tendency, but not strong for Demand Deposits to decrease in short-run, but in the medium and long- run this H1 accepted, which states that Demand Deposits will not decrease. It is because of crisis, which triggered Kazakhstani banks to accumulate and stimulate safe healthy funding and shift from risky volatile liabilities to the core liabilities.

Fig. 3. Large Time Deposits for 2006–2010 period [ Note — Compiled by author in accordance with data from current analyses]

On the Fig. 3. we see that Large Time Deposits during crisis 2008 at 4th quarter also slightly decreased, but after that constantly increased. So, our hypothesis result is: we reject H0 Decrease in large time deposits and accept H1 which states LTD will not decrease. This constant increase happened also due to the shifting from volatile to core liabilities and consolidation of deposits on Kazakhstan largest banks due to the crisis 2008.

Fig. 4. Multicurrency Deposits for 2006–2010 period [Note — Compiled by author in accordance with data from current analyses]

Fig. 4. shows us that Multicurrency deposits after the crisis 2008 sharply increased, which means that crisis negatively affected to national currency deposits. So, our hypothesis result is: we accept H0 which claims that crisis affect to the Increase in multicurrency deposits, and reject H1 which states that Multicurrency deposits will not increase under the effect of crisis 2008. It is due to the wave of second devaluation of national currency in Kazakhstan which happened in 2008 [13].

Table 7

Hypotheses results

|

No |

Hypothesis |

Accept |

Reject |

|

1 |

H0 if there are any patterns in decomposition of bank deposits among Kazakhstan banks; |

|

|

|

2 |

H0largerbanks have higher proportion of corporate deposits; |

|

|

|

3 |

H0 Decrease in demand deposits; |

s-run |

m-run l-run |

|

4 |

H0 Decrease in large time deposits; |

s-run |

m-run l-run |

|

5 |

H0 Increase in multicurrency deposits; |

|

Conclusion

Based on our analysis we revealed following Key findings:

1st objective:

The findings of the first objective were achieved through the using of descriptive statistics, and it was concluded that there are no any patterns in deposits decompositions among Kazakhstani banks. Consequently, Kazakhstani banks are free in choosing the most appropriate deposits decomposition based on their management. So, our first hypothesis result is:

– We reject H0 which states that there are any patterns in decomposition of bank deposits and accept H1 which states that there is no any patterns in the decompositions of deposits.

2nd objective:

According to prior studies to test whether the bank-specific factor such size of banks affecting to deposits decomposition of Kazakhstani banks we used regression analysis. As a result of our analysis we revealed that size of banks doesn't have any significant effect on the proportion of corporate versus individual deposits of our banks. Regression analysis showed us that relationship is insignificant. Therefore, size of our Kazakhstani commercial banks doesn’t affect to the composition of banks deposits:

We reject H0 and accept H1 which states that there is no significant differences in composition of deposits between large and small banks.

3rt objective:

Finally, in order to evaluate the effect of crisis on composition of deposits of Kazakhstani banks, based on international studies of Carlos D. Ramirez, 2010, Asli Demirguc-Kunt et al, 2014, Maria Soledad Martinez Peria, 1999, Victoria Ivashina and David Scharfstein, 2008, and Enrica Detragiache 2000 we used trend analysis.

By using trend analysis, we revealed that:

Demand deposits at first step, in short-run slightly decreased, then right after in medium and long-run, after the crisis — sharply increased. It is because of crisis, which triggered Kazakhstani banks to accumulate and stimulate safe healthy funding and shift from risky volatile liabilities to the core. So, our hypothesis result is:

– We reject H0 which states that demand deposits will decrease under the effect of crisis, because there is some tendency, but not strong for Demand Deposits to decrease in short-run, but in the medium and long-run this H1 accepted, which states that Demand Deposits will not decrease.

Large Time Deposits during crisis 2008 at 4th quarter also slightly decreased, but after that constantly increased. Thus, our hypothesis result is:

– We reject H0 which states that Large Time Deposits decreases and accept H1 which states Large Time Deposits will not decrease.

Multicurrency deposits after the crisis 2008 sharply increased, which means that crisis negatively affected to national currency deposits [13]. So,

– We accept H0 which claims that crisis affect to the increase in Multicurrency Deposits, and reject H1 which states that Multicurrency Deposits will not increase under the effect of crisis 2008.

Recommendation for further research

We used three analysis techniques and found solid answers based on the previous research and this is a fundamental reason behind the many challenges why current study is successfully completed. Subsequent studies should therefore be undertaken in order to provide thoroughly evaluation of banks’ deposits decomposition by the help of current research. Finally, two main issues for future research are revealed:

– Make more deeper evaluation of banks deposits decomposition by comparison between domestic banks and of foreign financial institutions which operates in Kazakhstan;

– Use Macroeconomic variables as an independent variable in further analysis;

References:

1. Martin Neil Baily Douglas J. Elliott, (July 11, 2013), “The Role of Finance in the Economy: Implications for Structural Reform of the Fin. Sector” p.5–7, [Retrieved- 20th October 2015]

2. Gillian G. Garcia, (1997); ISSN:1020–5098 Published July 1997; “Protecting Bank Deposits” p. 3–4, [Retrieved- 25th October 2015]

3. Sayed Janan, (2009); “Role Of Commercial Banks In The Economic Development Of A Country” [Retrieved- 5th November 2015]

4. Asli Demirguc-Kunt and Harry Huizinga, (2000) “Financial Structure and Bank Profitability”, [Retrieved- 28th March 2016]

5. Republic of Kazakhstan Financial System Stability Assessment, 2014; IMF Country Report No. 14/258 p.10–13; [Retrieved- 23th March 2016]

6. Jeanne Gobat, (2012) International Monetory Fund; “What Is a Bank?” [Retrieved- 28th March 2016]

7. Bill Mitchell, (2011) “Bank of England finally catches on — mainstream monetary theory is erroneous” [Retrieved- 21th March 2016]

8. Isabel Gorst (2013) Dr.Osman sahini, Isabel Gorst, Veleriya Anechshenko; [Retrieved- 5th November 2015]

9. Valeriya Anichshenko Nov. 2009 «The Impact of the Financial Crisis on the Banking System of Kazakhstan» Central Asia Business Journal, Vol. 2;

10. Marlène Laruelle, (11 dec., 2008)

11. KASE, Kazakhstan Stock exchange, 2006–2015. Financial statements of Kazakhstan second level banks;

12. Moses M. Sichei, November 2005; “Bank-Lending Channel in South Africa: Bank-Level Dynamic Panel Date Analysis” [Retrieved- 28th March 2016]

13. Margarita Bocharova, 12.02.2014; [Retrieved- 2 nd June 2016]