Capital outflow from Russia: causes and consequences

Автор: Золотухин Даниил Витальевич

Рубрика: Организация и управление хозяйством страны

Опубликовано в Вопросы экономики и управления №2 (24) апрель 2020 г.

Дата публикации: 13.03.2020

Статья просмотрена: 137 раз

Библиографическое описание:

Золотухин, Д. В. Capital outflow from Russia: causes and consequences / Д. В. Золотухин. — Текст : непосредственный // Вопросы экономики и управления. — 2020. — № 2 (24). — С. 5-10. — URL: https://moluch.ru/th/5/archive/162/4979/ (дата обращения: 24.04.2025).

Economic growth, which is the basis for improving the socio-economic situation of the country's population, is influenced by many factors of internal and external order. Among them, we especially emphasize the outflow of capital — a potential investment resource for economic growth and economic stability. This article assesses the extent of the problem, evaluates factors, and suggests ways to solve the problem.

Keywords: GDP, The Central Bank of Russian Federation, RANEPA, capital outflow, economic growth

Introduce

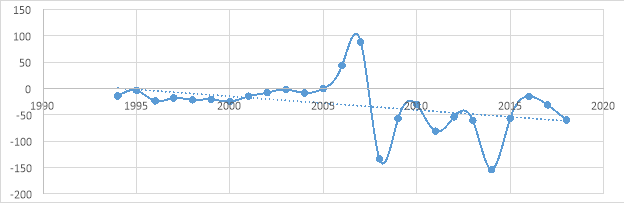

Due to the disintegration of the Soviet Union and the formation of the Russian Federation the barriers to capital flow disappeared. According to official statistics, money transfers were made throughout the whole period starting 1994 until now, except for two years. Look at figure 1.

Figure 1. Capital outflow/inflow statistics from 1994 to 2018, bill. rub.

The liberal reforms and privatization carried out since the 90s caused a number of problems one of which is capital outflow. Unfortunately, the measures to improve business and investment climate, as well as legislation, turned out to be not effective enough and a number of problems are still pending. The situation on the world market is complicated. With current economic sanctions, the capital outflow has a growing affect on the economic growth. Here is a short analysis of the causes and consequences.

Causes

The first factor is a shadow economy sector. According to the study by the Association of Chartered Certified Accountantants (ACCA), by 2017 the size of Russian unofficial sector of the economy was the fourth biggest in the world [1]. The Russian financial monitoring agency evaluates the size of the shadow sector in Russia in 2017 at RBL 18,9 trillion or 20,5 % of the GDP; in 2018 at RBL 20,7 trillion or 20 % of GDP [2]. A significant part of cashflows in the country has been received by illegal methods. There are two ways of its further disposal: transfer to offshore zone and its use abroad; the second is legalization in Russia and official transfer overseas.

The Central Bank divided the doubtful operations into three types. The first is prepayments sent abroad without getting goods in return. The second is products sent abroad without any payments. The third is fictitious operations with securities, credits and other financial instruments.

Table 1

Share of doubtful operations in capital outflow.

|

Indicator/Year |

2014 |

2015 |

2016 |

2017 |

2018 (the 3rd quarter) |

|

Capital outflow, bill. rub. |

154,1 |

56,9 |

15,4 |

31,3 |

19,2 |

|

Doubtfuloperations, bill. rub. |

8,607 |

1,531 |

0,541 |

0,204 |

0,2 |

|

Doubtful operations,% of all |

5,6 % |

2,6 % |

3,5 % |

0,7 % |

1 % |

The main part of cash outflow is legal operations such as investments, import, repatriation of foreign companies’ incomes obtained on Russian territory etc. As to retail market sails: many biggest retail chains are foreign companies so their income moves overseas. There are some Russian owners of such big retail companies that are registered in offshore zones. The table below shows statistic data of the share of retail market chains in the overall market turnover.

Table 2

Volume of retail market chains in overall turnover of the market

|

Indicator/Year |

2016 |

2017 |

2018 |

|

The retail market turnover, bill. rub. |

28 240,9 |

29 745,5 |

31 579,4 |

|

Share of retail market chains,% |

27,5 % |

30,7 % |

32,6 % |

Dynamics of the data demonstrate the rise of the chains market share in overall turnover. This means the rise of capital outflow and consequent economic growth retardation. There are different forms of legal movement of capital abroad and not only by foreign companies.

Investment climate in the country is another reason of capital moving out because there are strong concerns about the tendencies of the fiscal tax system as there were already introduced forty changes into the Tax code in 2018. The private sector cannot feel safe because their capital can be confiscate.

Consequences

Permanent capital outflow is a threat to economic security as it creates deficit inside the country. The government regulates economic activity and protects business and citizens, but deficit situation is extraordinary and the authorities tries to find an adequate solution. Income clauses of the State budget are represented by taxes, in the first hand. Rising taxes made business less profitable. As a result there are no investments in new equipment, technologies and man power tuition. In the the long run it is going to result in absence of technological innovations and immigration of qualified scientists eager to pursue valid careers. Stable economic growth results from social and scientific discoveries which cannot be achieved without investments.

Decreasing profits in private sector also led to depreciation of fixed assets. The problem of old equipment is typical among producers. Workmanship of goods and effectiveness of production depend on productive facilities. GDP keeps rising only provided that the base for such growth is available. With funds that lack even to repair the available equipment the production and workmanship inevitably decline.

The wealth of citizens is the main part of economic security. In deficit conditions companies do not have enough money to pay wages so the general level of salaries is decreasing. If the level of income is not sufficient for comfortable life people start looking for additional sources. Stress and overwork cause mass health problems and the social tension grows.

Solution measures

Solving state problems is the government’s responsibility. To improve investment climate, to form payable demand inside the country and to return capital the government has to develop domestic production and provide safety to private sector.

To return capital and to improve investment climate there has been announced capital amnesty program consisting of three steps the last of which is now being carried out. There has been provided amnesty in certain cases on condition of money returned to the country. The aim of the program is to raise the confidence of business in the state as well as to return the money. There were 19 000 declarations submitted during the first two steps [6]. Within the frame of this program however, there has been a case in which a declaration was considered to be the proof of guilt. This undermines the confidence in the government.

Another direction of the measures preventing the outflow of capital is the development of entrepreneurship inside the country. The Federal law #209 of 24.07.2007 aimed at the development small and medium businesses was adopted to help private households enter the market. The governmental program of agriculture development is based on this act. Similar acts were introduced in other sectors.

The main task is not just adopting a law but ensuring its enforcement. With agriculture evolving and expending production, the basic question is who will buy the products? The main customers are retail market chains registered overseas which influence the prices. To achieve better efficiency there must be a good mechanism of control and surveillance. Different political tendencies inside the country make this task more difficult. We have to develop traditional institutions to rise the interest of the citizens to live here and to build international relationships as an efficient response to world’s challenges. The best conditions are those in which people can have an opportunity of comfortable living. The crucial measures for such result have to improve the wealth of people by subsidizing labour market to rise wages, by accumulation of social welfare such as free tours for children and pensioners as well as by developing social sectors of medicine, education and creating solid town infrastructures.

Currently the measures to stop capital outflow have no effect. Capital keeps moving overseas which affects every citizen of the country and the firms.

References:

- Boon Yew Ng. Emerging from the shadows. The shadow economy to 2025 // ACCA. — 2017 P. 11.

- Russia enters top five shadow economy countries | Россия вошла в пятерку стран с крупнейшей теневой экономикой // RBC.ru. URL: https://www.rbc.ru/economics/30/06/2017/595649079a79470e968e7bff

- Golubev S. V. EMISS, Bureau of government statistics: the indicator of the share of retail market chains in the whole retail sales turnover.

- The Central Bank of Russian Federation: Statistics of net capital outflow.

- The federal law № 209 from 24.07.2007

- The Ministry of finance disclosed the number of declarations submitted during the first two periods of amnesty to capital | Минфин назвал число деклараций, поданных в ходе первых двух этапов амнистии капиталов // TASS.ru. URL: https://tass.ru/ekonomika/6336022

Ключевые слова

GDP, The Central Bank of Russian Federation, RANEPA, capital outflow, economic growthПохожие статьи

Ukrainian export potential on grain market

Export potential is the main characteristic of a country's economic strength and an indicator of its prospects and sustainability in the international arena. Export potential of grain market today is one of the few ways for Ukraine to provide its lon...

Russian — Chinese innovation cooperation

The innovative scenario of development of Russia is defined by the Russian Government as a key priority. Now, innovative development reached the new level due to the recent events — the American and European sanctions in a consequence of economic and...

Investment activity as a condition of economic development

A necessary condition for the development of the economy is a high investment activity. It is achieved by increasing the volume of investment resources sold and their most effective use in the priority areas of material production and the social sphe...

Specifics of positioning in the banking sector on the example of Alfa-Bank JSC

The article discusses the main trends of positioning in the field of banks and finance, their differences from other sectors of the economy, factors of influence. As an example, the image and reputation of Alfa-Bank, one of the largest private banks ...

Economic importance of development of oil and gas system

This research examines the economic importance of developing oil and gas systems. It explores the historical and contemporary contributions of the industry to global economic growth, national development, and regional prosperity. The paper analyzes t...

Small businesses in the national economic structure

In modern economy, importance is given to small businesses. Thus, increasingly, economic development specialists are abandoning traditional approaches to economic development, which rely on a set of large enterprises with tax breaks, financial incent...

Пути повышения эффективности банковской системы РФ в условиях кризиса

The financial crisis in Russia in 2008 revealed the main problems of the Russian Federation banking system. The problems had surely been concealed before the crisis and they are the following: poor and problem assets, insufficient capitalization of t...

Transport and logistics: issues and issues Strategy for Guinea

The objective of this article is to identify the problems of transport and logistics in Guinea, in order to have a reliable and fine-grained view on the state of the supply chain. We have developed this problem by approaching, the importance and role...

Development and progress of small businesses

In the article the development and progress of small business as well as its place in the economy of our country in conditions of liberalization and deep structural changes is considered. In addition, the created economically favorable conditions and...

Assessing the role of gross expenditures on R&D in Russia’s economy

This paper is intended to fill a gap in economic literature concerning the influence of R&D on developing countries. The empirical analysis is based upon the data representing various indicators of the Russian economy in the period between 1999 and 2...

Похожие статьи

Ukrainian export potential on grain market

Export potential is the main characteristic of a country's economic strength and an indicator of its prospects and sustainability in the international arena. Export potential of grain market today is one of the few ways for Ukraine to provide its lon...

Russian — Chinese innovation cooperation

The innovative scenario of development of Russia is defined by the Russian Government as a key priority. Now, innovative development reached the new level due to the recent events — the American and European sanctions in a consequence of economic and...

Investment activity as a condition of economic development

A necessary condition for the development of the economy is a high investment activity. It is achieved by increasing the volume of investment resources sold and their most effective use in the priority areas of material production and the social sphe...

Specifics of positioning in the banking sector on the example of Alfa-Bank JSC

The article discusses the main trends of positioning in the field of banks and finance, their differences from other sectors of the economy, factors of influence. As an example, the image and reputation of Alfa-Bank, one of the largest private banks ...

Economic importance of development of oil and gas system

This research examines the economic importance of developing oil and gas systems. It explores the historical and contemporary contributions of the industry to global economic growth, national development, and regional prosperity. The paper analyzes t...

Small businesses in the national economic structure

In modern economy, importance is given to small businesses. Thus, increasingly, economic development specialists are abandoning traditional approaches to economic development, which rely on a set of large enterprises with tax breaks, financial incent...

Пути повышения эффективности банковской системы РФ в условиях кризиса

The financial crisis in Russia in 2008 revealed the main problems of the Russian Federation banking system. The problems had surely been concealed before the crisis and they are the following: poor and problem assets, insufficient capitalization of t...

Transport and logistics: issues and issues Strategy for Guinea

The objective of this article is to identify the problems of transport and logistics in Guinea, in order to have a reliable and fine-grained view on the state of the supply chain. We have developed this problem by approaching, the importance and role...

Development and progress of small businesses

In the article the development and progress of small business as well as its place in the economy of our country in conditions of liberalization and deep structural changes is considered. In addition, the created economically favorable conditions and...

Assessing the role of gross expenditures on R&D in Russia’s economy

This paper is intended to fill a gap in economic literature concerning the influence of R&D on developing countries. The empirical analysis is based upon the data representing various indicators of the Russian economy in the period between 1999 and 2...